Dear Client

We are wishing you a great start to the new year and health, happiness, and prosperity in 2023.

Welcome to our quarterly newsletter which has turned into the newsletter we write when we have time to put something together, we think adds value.

Two thoughts to begin the year:

“Learn from yesterday, live for today, hope for tomorrow.”

– Albert Einstein

„I do not make resolutions for the New Year but visualize and plan things.“

– Amala Akkineni

Which translates roughly to: Hope is good. Strategy and planning better.

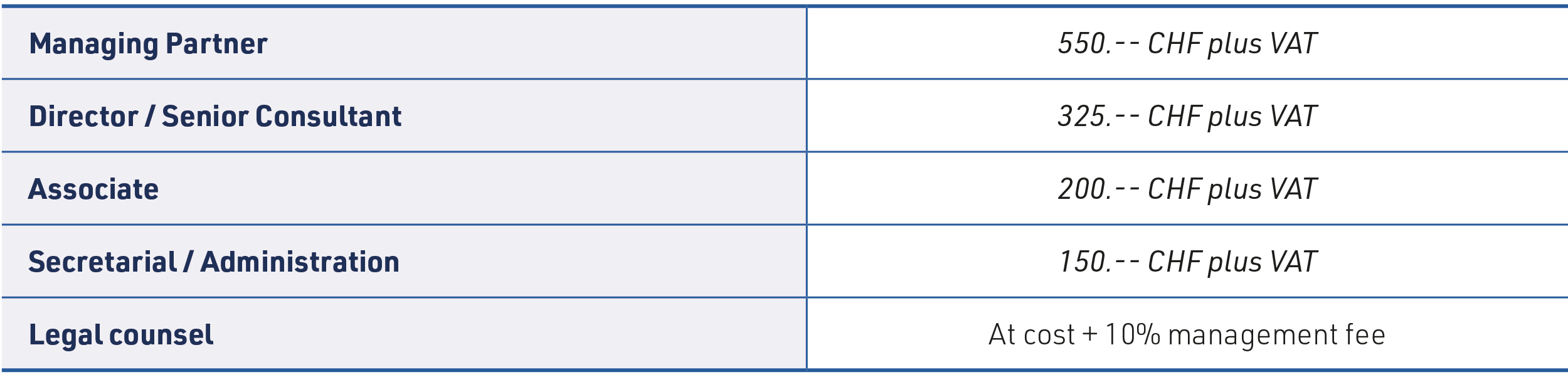

1. AVIOLO UPDATE – PRICING

After eight years of a „one price fits all“ approach, we are introducing a structured fee schedule.

As of 1 January 2023, for tasks, activities, mandates not covered by „All-In“ compliance outsourcing arrangements, Aviolo will work on the following hourly fee basis:

This has become necessary due to growth in the practice, more complex service delivery and is a reflection of our cost structure in delivering a broader, deeper and more varied range of legal, regulatory and compliance services to our clients.

This has become necessary due to growth in the practice, more complex service delivery and is a reflection of our cost structure in delivering a broader, deeper and more varied range of legal, regulatory and compliance services to our clients.

Having grown in capacity, clients, people and range and depth of services being offered, Aviolo is becoming a full service legal, regulatory and compliance services firm. With more additions to the business coming in 2023, in line with our strategy and objective of coordinated, integrated service delivery along the continuum of legal, regulatory and compliance services.

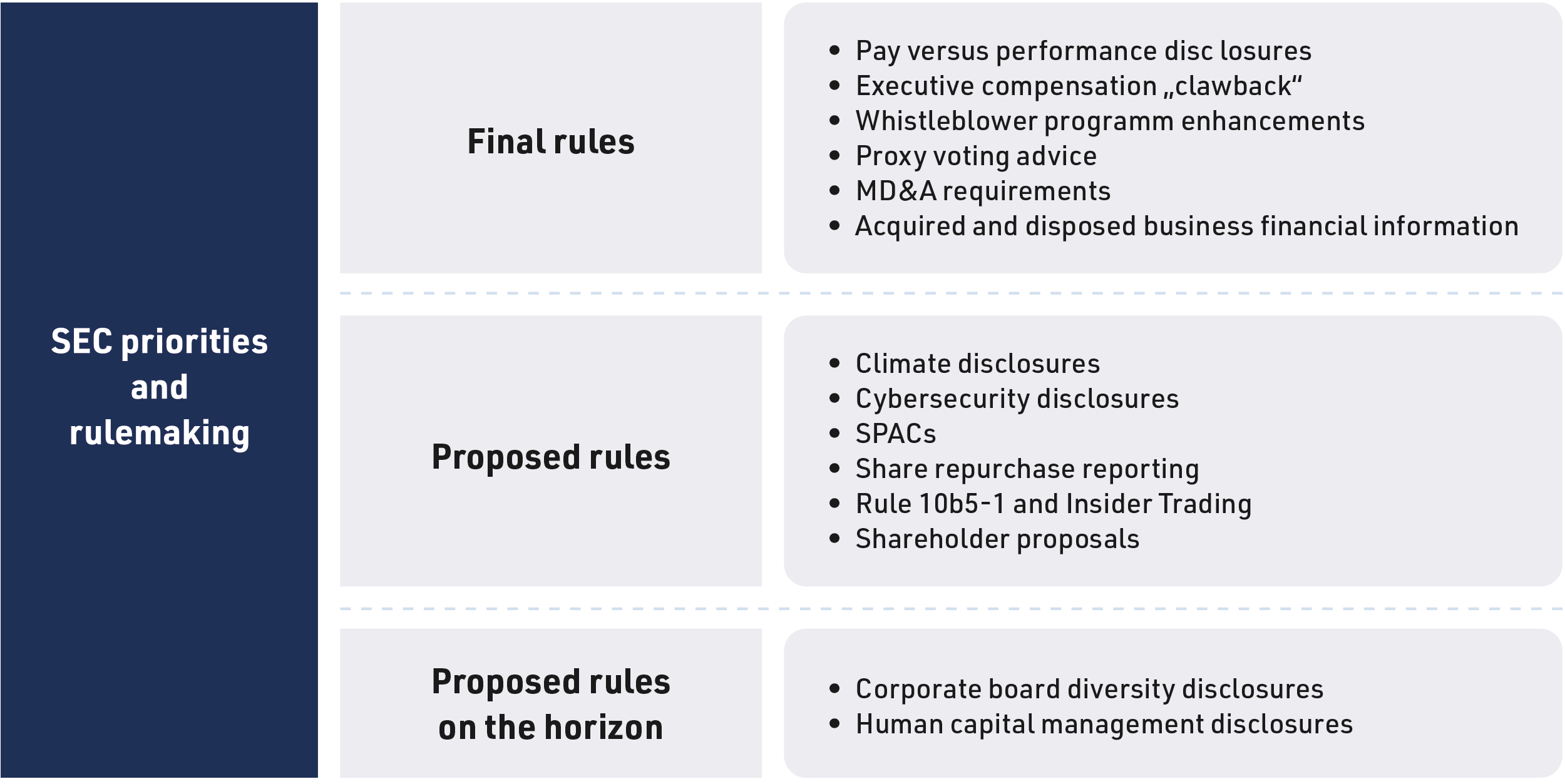

2. SEC US LEGAL REGULATORY AND COMPLIANCE UPDATE

For completeness‘ sake, here is an overview of SEC priorities and rulemaking.

Most of which is arguably of limited interest to the Swiss RIA community, hence we focus on what we believe most relevant.

Most of which is arguably of limited interest to the Swiss RIA community, hence we focus on what we believe most relevant.

1. The New Investment Adviser Marketing Rule

As everyone reading this well knows, on December 22, 2020, the SEC adopted significant reforms to modernise rules governing investment adviser advertisements and payments to solicitors. These amendments resulted in a single rule that replaced previous advertising and cash solicitation rules. The compliance date for the amended Marketing Rule was November 4, 2022.

In Advisers need to update or revise their written policies and procedures as required by Advisers Act Rule 206(4)-7, to ensure they are reasonably designed to prevent violations of the Marketing Rule. Advisers Act Rule 204-2 (Books and Records Rule), requires advisers to make and keep records of all advertisements they disseminate, including certain internal working papers, performance related information, and documentation for oral advertisements, testimonials, and endorsements.

1.1 Key areas

1.1.1 Policies and Procedures

Advisors need to adopt and implement written policies and procedures that are reasonably designed to prevent violations by the advisers and their supervised persons of the Advisers Act and the rules thereunder, including the Marketing Rule.

P&Ps should include objective and testable means reasonably designed to prevent violations of the rule in advertisements the adviser disseminates. Examples of objective and testable means could include conducting an internal pre-review and approval of advertisements, reviewing a sample of advertisements based on risk, or pre-approving templates.

1.1.2 Substantiation Requirement

An adviser must have a reasonable basis for believing they will be able to substantiate material statements of fact in advertisements. The Marketing Rule prohibits advertisements that “include a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the Commission.

The SEC has stated that

“advisers would be able to demonstrate this reasonable belief in a number of ways. For example, they could make a record contemporaneous with the advertisement demonstrating the basis for their

belief. An adviser might also choose to implement policies and procedures to address how this requirement is met. However, if an adviser is unable to substantiate the material claims of fact made in an advertisement when the Commission demands it, we will presume that the adviser did not have a reasonable basis for its belief.”

Essentially, again, document everything.

1.1.3 Performance Advertising Requirements

Include prohibitions on including the following in an advertisement:

- gross performance, unless the advertisement also presents net performance;

- any performance results, unless they are provided for specific time periods;

- to the extent an advertisement includes the performance of portfolios other than the portfolio being advertised, performance results from fewer than all portfolios with substantially similar investment policies, objectives, and strategies as the portfolio being offered in the advertisement, with limited exceptions;

- performance results of a subset of investments extracted from a portfolio, unless the advertisement provides, or offers to provide promptly, the performance results of the total portfolio;

- hypothetical performance, unless the adviser adopts and implements policies and procedures reasonably designed to ensure that the performance is relevant to the likely financial situation and investment objectives of the intended audience and the adviser provides certain additional information.

1.1.4 The cash solicitation rule

The cash solicitation rule has been merged into the Rule, with solicitation activity being covered under the definition of endorsements. That definition includes any statement by a person, other than a current client or investor in a private fund advised by the investment adviser, that directly or indirectly solicits any current or prospective client or investor to be

(i) a client of the investment adviser;

(ii) an investor in a private fund advised by the investment adviser.

The following sets forth a number of the significant aspects of the new Rule that you should be aware of.

1.1.5 Compensation

The Rule requires now disclosure of both cash and non-cash compensation. Therefore, a

solicitor relationship will exist regardless of whether the solicitor is compensated with cash or with non-cash compensation. Compensation covered by the Rule includes flat fees, retainers, hourly fees, reduced advisory fees, fee waivers, and any other methods of cash compensation.

1.1.6 Contractual Agreement

A solicitor relationship must be documented in a written agreement between the adviser and the solicitor. The adviser no longer needs to obtain a written acknowledgement from each referred client that the client has received the required disclosures from the solicitor, and the solicitor no longer needs to deliver a copy of the adviser’s brochure (Form ADV Part 2A) to the prospective client.

Exceptions to this requirement occur where the person giving the endorsement / solicitation is an affiliate of the adviser, or such person receives de minimis compensation (i.e., $1,000 or less, or the equivalent value in non-cash compensation, during the preceding twelve months).

1.1.7 Disclosure requirement

Certain information must be disclosed, either in writing or verbally, in connection with a

solicitation pursuant to the Rule.

Advisers must “clearly and prominently” disclose, or reasonably believe that the person giving the endorsement discloses, whether the person giving the testimonial or endorsement is a client or private fund investor, a description of the compensation provided or to be provided, directly or indirectly, and a description of the “material” conflicts of interest on the part of the person giving the endorsement.

The required disclosures should be provided at the time such testimonial or endorsement is disseminated. Either the adviser or the solicitor may make the required disclosures. If the adviser does not make the disclosures, it must have a reasonable belief that the solicitor is doing so.

2. E-Device use and communications – WhatsApp,

Signal, Telegram, and others

This is a highly relevant topic. The Division of Examinations is looking closely at how firms handle

e-devices. By e-devices is meant the use of WhatsApp and other informal communications

platforms, usually on personal devices. Everyone uses them, and often, we hardly think about it. The SEC is very clear about this, Books & Records; Advisors need to record business communications, regardless of the device or medium used.

SEC examiners are looking closely at whether e-communications for business are all being

recorded. Obviously, given the scope and potential for fraud when using non-recorded personal devices.

Not recording these communications with clients is a Books & Records violation. If firm staff are permitted to use personal devices for work, Advisors must keep the records of those com-

munications. In 2022 the DOE went after 16 firms in 11 related enforcement actions, covering for example Goldman Sachs, Nomura, Morgan Stanley, and others. Fines totaled over 1.1 Billion USD. To put that into context the SECs annual budget is (only) 2 Billion USD.

For interest and completion, the main firms and fines:

- Barclays Capital ($125M)

- BOA / Merrill Lynch ($125M)

- Citigroup ($125M)

- Credit Suisse ($125m)

- Goldman Sachs ($125M)

- Jefferies ($50M)

- Morgan Stanley ($125M)

- Nomura Securities International (50M$)

- UBS ($125M)

Yes, Credit Suisse and UBS both got nailed. After a while you almost come to expect that if a group of banks is going to get nailed, CS and UBS will be in the group of repeat offenders.

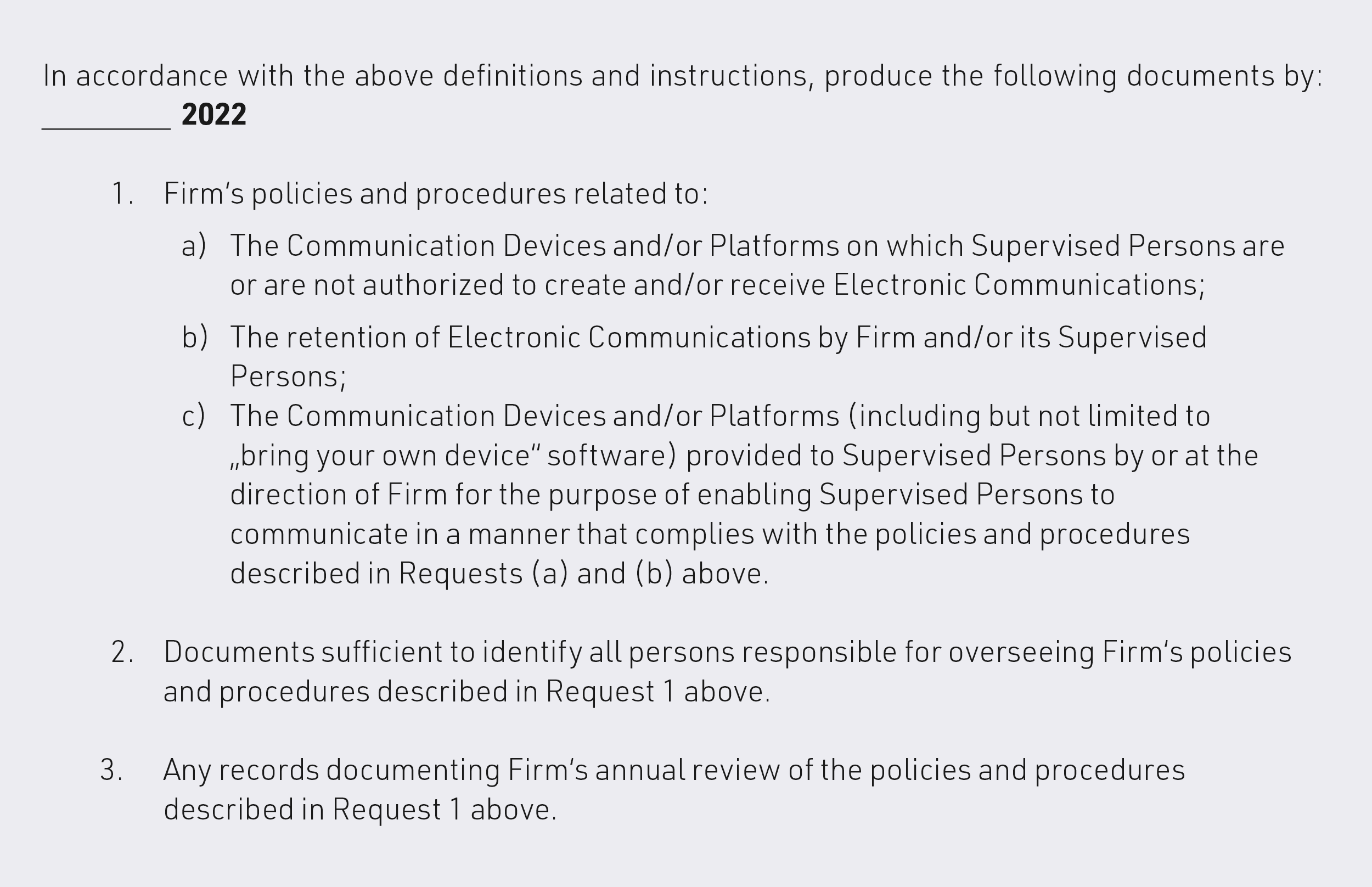

2.1 Creating electronic communications

A segment from a recent DOE document request letter illustrates SEC interest in advisors P&Ps regarding supervised persons who are creating electronic communications. Excerpt as follows:

C. Documents to be Produced

Recommendation? Have all supervised persons using a company issued phone for work with automated archiving.

Recommendation? Have all supervised persons using a company issued phone for work with automated archiving.

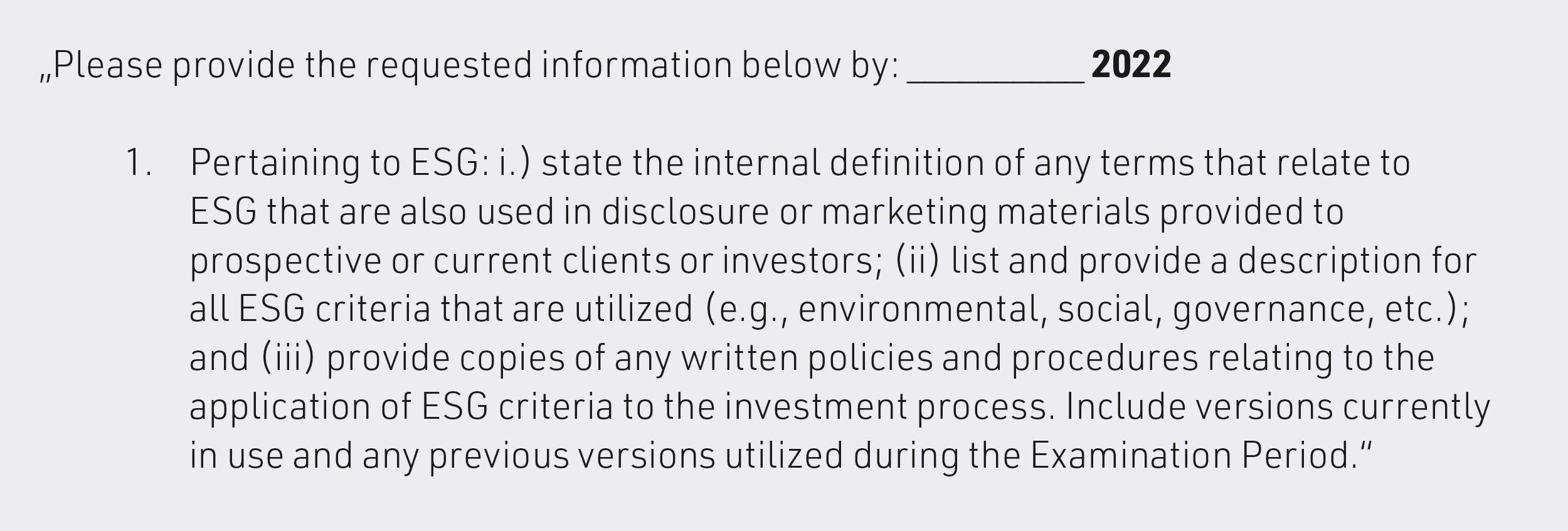

3. ESG Focus

As ESG grows, the SEC is becoming really interested in what advisors are up to in the space.

Document request letters are starting to become very specific about what the SEC is interested in (Examples available on request).

Some highlights, request for;

- „brief written explanation“ for any ESG investments or divestments that occured during the exam period;

- details of the three most profitable and three least profitable ESG investments;

– Also to include „copies of all research and due diligence files, e.g., personnel research notes, notes of meetings with issuer management personnel or with customers and consultants/experts, third party analyst reports, issuer offer documentation, issuer financial statements, etc. for those investments that were used“ so goes the letter. - items addressed included ESG standards used by the firm and ESG scores;

- communications with issuers around ESG along with copies of contracts with ESG providers.

An example paragraph from one of the letters:

Advisors pursuing ESG strategies would be advised to document everything very carefully and extensively.

Advisors pursuing ESG strategies would be advised to document everything very carefully and extensively.

4. Annual Review

It‘s the beginning of the new year, so as a reminder, Rule 206(4)-7 requires investment advisers

to review, no less frequently than annually, the adequacy of the compliance policies and

procedures and the effectiveness of their implementation.

The annual review generally involves at a minimum:

- i: A comprehensive review of the compliance program’s adequacy

- ii. Review findings, recommendations and implementation of remedial measures from previous annual review

- iii. Prepare report containing findings from the review, comments on overall status, findings and recommendations for improving the firms compliance program

- iv. Prepare status update on implementation of any remedial measures as recommended in previous annual review

- v. Define and agree remediation and other measures and actions to be taken

resulting from the review with appropriate timeline

It is always a good practice to have an independent party provide a second set of eyes on

policies & procedures and the annual review. If there are any concerns about gaps in the

compliance program or documentation of the the review, do not hesitate to reach out.

3. SWISS LEGAL, REGULATORY AND COMPLIANCE UPDATE

I am not going here. Anything I could say is on the FINMA website, in numerous presentations and in the public domain. To try to add anything adds no value.

4. THE MORATORIUM ON NEW REGISTRATIONS IN SWITZERLAND – UPDATE

There is no update available.

As has been previously said, the matter is currently with FINMA. However, there has been no update from FINMA since August 2022. An enquiry to the SEC on 16 September 2022 resulted in the following.

„SEC staff continues to engage with the Swiss Financial Market Supervisory Authority (FINMA).

Unfortunately, we cannot share anything further at this time, as we can only provide status updates with regard to individual applicants.“

If you wish to enquire, the FINMA Email address is: questions@finma.ch

5. FTX. A POINT OF VIEW AND CONSEQUENCES FOR SWITZERLAND

In keeping with our tradition of closing with some (tragi-)comedic relief. Plus, it is going to have a real impact on digital asset and cryptocurrency regulation and compliance going forward.

For anyone who has been on Mars for the last few months, FTX, a high flying cryptocurrency

exchange worth around 40 Billion USD imploded in November. Some say pushed along by a competitor, Binance whose CEO, some say… decided the timing was opportune to put their main competitor out of business.

FTX was founded in 2019 by Sam Bankman-Fried and partners, and at its peak in July 2021, had well over one million users (the exact number is hard to determine). It was the worlds third largest cryptocurrency exchange by volume. FTX was incorporated in Antigua and Barbuda and headquartered in the Bahamas. FTX was not registered with the SEC or regulated by the CFTC. Bankman-Frieds net worth peaked at $26 billion.

Once you get past the crypto fluff, there does not seem to be anything particularly complicated about the fundamentals of the case. On the basis of information available and congressional hearings with the incoming CEO, John Ray III (the man who cleaned up the Enron implosion), FTX appears to be a case of fairly simple theft and embezzlement of client funds. The owners of a company stealing cash from customers and using that cash for their own ends.

What actually happened? It seems that:

- Customers gave money to FTX.

– Supposedly in segregated accounts - Sam Bankman-Fried directed FTX to pay customer funds to Alameda Research

– The trading firm run by the ex-(?) girlfriend - Alameda research, run by Caroline Ellison

– Traded and lost money

– Passed a lot of money back to Bankman-Fried in the form of various loans, payments, investments, etc. - Binance, the world’s biggest crypto exchange, announced it was selling all holdings of FTXs native token FTT

– Precipitating a spike in customer withdrawals - FTX was unable to pay customers

- Seeks bailout from first the venture capitalists, then Binance

- Fails to get financing

- Result: Bankruptcy

Bankman-Fried was arrested on Dec. 12, 2022 and extradited to the U.S. shortly after. When announcing the charges against Bankman-Fried, the U.S. attorney stated that it was one of the largest financial crimes in American history. New FTX CEO Ray told the U.S. House committee on Dec. 13 that FTX practiced „no bookkeeping.“, and that, „It was old-fashioned embezzlement.“

Bankman-Fried has been indicted on eight counts, including securities fraud and money

laundering. He was released from custody after his attorneys and federal prosecutors agreed to a $250 million bond, the largest bond in history. He is now living with his Stanford law professor parents in Palo Alto, California, confined to the Northern California area, and sports a very

dashing electronic monitoring bracelet.

On January 3, 2023, Bankman-Fried pled not guilty.

You couldn‘t make this up. And this was all missed by the great and good of both the regulatory world and the venture capital industry. It will be fascinating to see how the case develops and its impact on cryptocurrency regulation going forward.

If you have questions or any comments on this newsletter, please don’t hesitate to get in touch.

Martin Straub, Michaela Portal, Christoph de Weck

Aviolo Compliance Solutions

Seefeldstrasse 94

8008 Zürich

Tel: +41 44 552 0387

https://aviolo.ch